Consultation Terms & Conditions

These Terms & Conditions apply to all consultation services booked through Expat Taxes UK (“Expat Taxes”, “we”, “us”). By booking a consultation, you agree to be bound by the terms below.

1. Nature of Services

- Consultations provide preliminary, high-level tax advice tailored to the information you provide at the time of booking.

- A consultation is not intended to be an exhaustive analysis or a substitute for ongoing tax or legal representation.

- It is not formal written tax advice and should not be relied upon for submission to HMRC or other tax authorities without further work.

- If your matter requires more detailed review (e.g. offshore trusts, corporate structuring, or complex residency matters), your advisor will explain this and may propose a separate engagement with additional fees.

2. Independent Advisors

- Expat Taxes connects you with a qualified, independent tax advisor (“Advisor”).

- Following your consultation, you may choose to continue working directly with your Advisor. Any subsequent engagement is between you and the Advisor directly and will be subject to their firm’s own terms of business.

- Expat Taxes is not responsible for the quality, accuracy, or completeness of advice provided by Advisors. Any service-related concerns must be raised with the Advisor directly.

3. Bookings & Payment

- Consultations are booked through Expat Taxes’ online platform.

- Full payment is required at the time of booking.

- All consultation fees are non-refundable, except as expressly provided in these Terms.

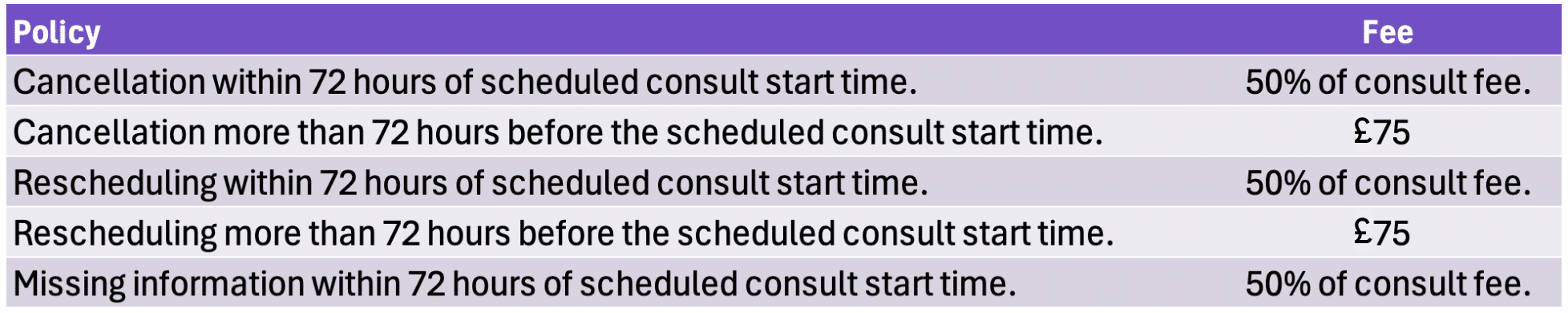

4. Cancellation & Rescheduling Policy

We understand that plans may change. Our cancellation and rescheduling policy ensures fairness for both clients and advisors:

- A one-time reschedule may be offered free of charge, subject to availability. We cannot guarantee the same Advisor or time slot.

- Rescheduling and cancellation requests must be submitted in writing to info@expattaxes.co.uk during business hours (Monday–Friday).

5. Client Responsibilities

To enable your Advisor to provide accurate advice, you must:

- Complete the pre-consultation questionnaire provided 72 hours in advance of you consultation.

- Complete an AML identify verification check, a standard requirement for compliance with UK anti-money laundering legislation (includes the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017 (as amended), the Proceeds of Crime Act 2002, and subsequent amendments).

- Ensure all information provided is accurate and complete.

Expat Taxes and your Advisor cannot be held responsible for penalties, tax liabilities, or errors arising from incomplete or inaccurate information provided by you.

6. Confidentiality & Data Protection

- Expat Taxes and your Advisor will treat your information as confidential and comply with applicable data protection laws.

- Consultation records should be retained by you for at least six years, as HMRC may request them for compliance purposes.

- You may not record your consultation or share advice received with third parties without written permission.

- Please note that consultations may be recorded by your tax adviser for security, training, and quality assurance purposes. Any such recordings are treated as strictly confidential and handled in accordance with our data protection policies.

7. Limitations of Advice

Consultations reflect UK tax law and HMRC practice at the date of the meeting. Laws and interpretations may change, and neither Expat Taxes nor your Advisor accepts responsibility for updating advice once given.

Advice given is based on the facts and information you provide. If circumstances change or additional facts come to light, further advice may be required.

Unless agreed in writing, consultations do not include:

- Preparation or filing of tax returns

- Investment or financial advice

- Legal representation in disputes or litigation

Your Advisor may give initial high-level guidance on the following areas, but further engagement will be required:

- Offshore trusts and estate planning

- Complex corporate structuring

- Detailed analysis of offshore funds

- Comprehensive double taxation planning

- Exit planning or business restructuring

8. Liability

- Expat Taxes acts as a booking and payment platform only. We do not provide tax advice and are not liable for advice given by Advisors.

- Any liability for the consultation rests solely with the independent Advisor who provides the service.

- To the fullest extent permitted by law, Expat Taxes excludes all liability for any loss, damage, or claims arising from your consultation, except where caused by our own negligence or fraud.

9. Governing Law

These Terms are governed by the laws of England and Wales. Any disputes shall be subject to the exclusive jurisdiction of the courts of England and Wales.

10. Contact

By booking and paying for a consultation, you confirm that you:

- Have read and understood these Terms & Conditions.

- Accept that the consultation is a preliminary discussion only.

- Understand that further services require a separate engagement.

For bookings, cancellations or rescheduling, please email info@expattaxes.co.uk.